arizona solar tax credit 2022

2022 Extension and Increase of Arizona Solar Tax Credit The House of. In addition to the Residential Clean Energy Credit most Arizona residents are eligible for the state solar tax credit.

Arizona Solar Incentives And Rebates 2022 Solar Metric

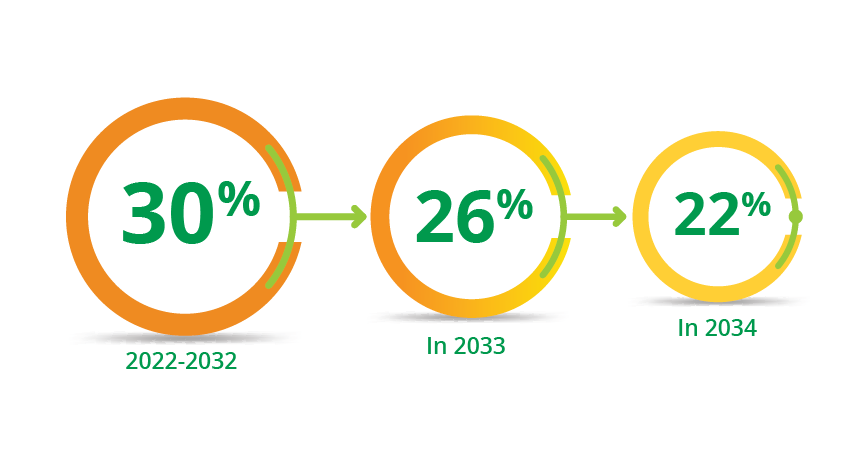

Varies by provider and subject to change without notice 30 Solar Investment Tax Credit ITC.

. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Arizonas Tax Incentives and Solar Rebate Programs. Just because of this fact alone you can save a lot of money here with solar.

This applies to installations in 2022. What Happens To A Solar LeaseSolar PPA After Death. In Arizona you can claim up to 1000 in tax credits for switching to solar energy.

The state tax credit is valued at 25 of the total system cost up to a. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. The utility company is currently offering a limited-time rebate of 300 per kilowatt-hour kWh up to 3600 for customers who install a home battery and agree to participate in their battery.

23 rows ADOR will be sending renewal letters to filers to renew their 2023 Arizona Transaction Privilege Tax License. The tax credit remains at 30 percent of the cost of the system. The new Clean Energy Credit is valid until 2035.

The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. Residential Arizona Solar Tax Credit of 25 up to 1000 off your personal state income tax. You pay a set monthly.

The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. Federal Solar Tax Credit. In August 2022 the Inflation Reduction Act laid out new provisions for the ITC now titled the Clean Energy Credit.

Arizona Solar Tax Credit. Solar energy systems are exempt from the states 56. Arizona is one of the sunniest states in the country.

State sales tax exemption. Income tax credits are equal to 30 or 35 of the investment amount. The core differences between a solar lease and a Power Purchase Agreement PPA are simple.

This means that in 2017 you can still get a major discounted price for your. This incentive reimburses 25 of your system cost up to 1000 off of your. Solar panels cost an average of 15000 to 20000 in Arizona which is a significant investment.

State of Arizona Tax Credit. The Solar Investment Tax Credit ITC also known as the Federal Solar Tax Credit allows you to claim 26 of the total cost of installing a solar energy system on your federal taxes. Summary of Arizona solar incentives 2022.

The Arizona Solar Tax Credit makes it more affordable for Arizona residents to purchase a solar system. 2022 the 30 solar tax credit that. The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program.

Fortunately the Grand Canyon State offers several tax credits to reduce these costs. At the federal level the Investment Tax Credit ITC gives you a credit for 26 of the cost of your solar energy system. AZTaxes filers must renew online.

2 According to our market research and data from. This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

Here are the specifics.

Why Do Arizona Homeowners Go Solar Sunsolar Solutions

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar Llc

Solar Panels For Arizona Homes Low Cost High Sun

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Safford Az Solar Panel Installation Company Solar Direct

An Arizona Utility Just Lost In Appeals Court For Price Gouging Rooftop Solar Customers

Incentives Pgt Solar Solutions Arizona S Trusted Solar Team

Arizona Solar Tax Credit Phoenix Solar Panel Systems

Virginia Solar Incentives Tax Credits Rebates Guide 2022

Solar Energy Tax Incentives By State Northern Arizona Wind Sun

Solar Incentives In Arizona Sunny Energy

Free Solar Panels Arizona What S The Catch How To Get

Complete Your 2021 Arizona And Irs Taxes Now On Efile Com

30 Federal Solar Tax Credit A Buyer S Guide 2022

Pricing Incentives Guide To Solar Panels In Hawaii 2022 Forbes Home

Solar Incentives By State Rebates Tax Credits And More Unbound Solar